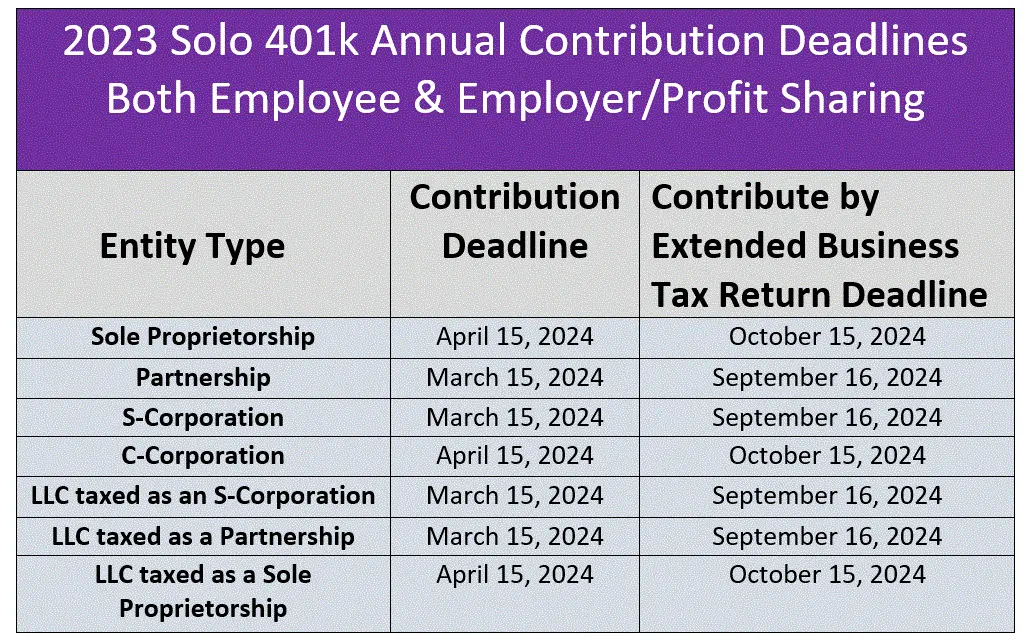

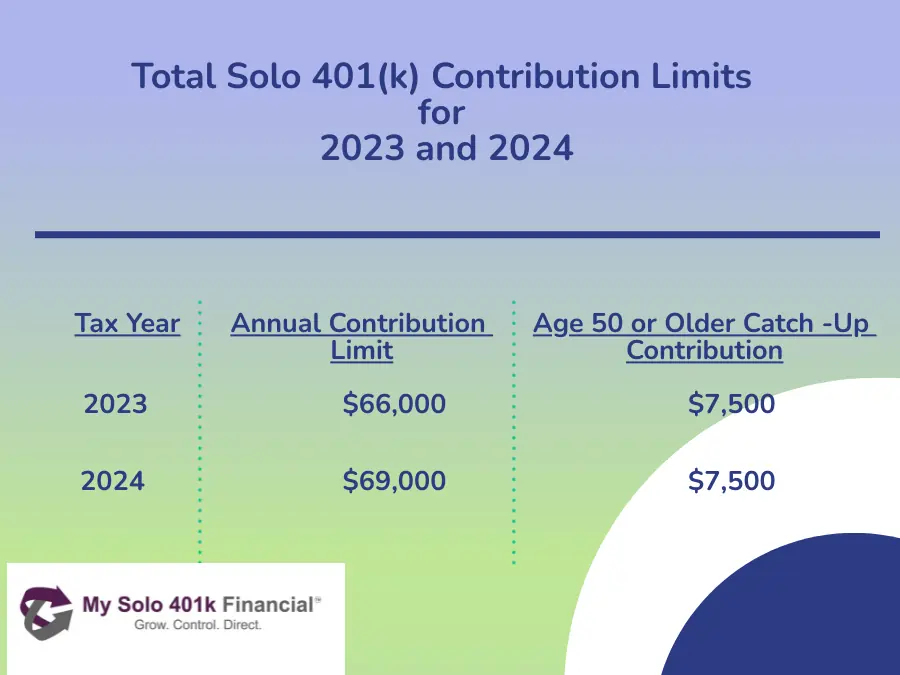

Solo 401k Employee Contribution Limits 2025 - For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at least age 50. Federal 401k Contribution Limit 2025 Gaby Pansie, What are the new solo 401k contribution limits for 2025? How much can i contribute to my solo 401 (k) in 2025 and 2023?

For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at least age 50.

Wwe Current Roster 2025. Champions on each brand will be protected and are not eligible […]

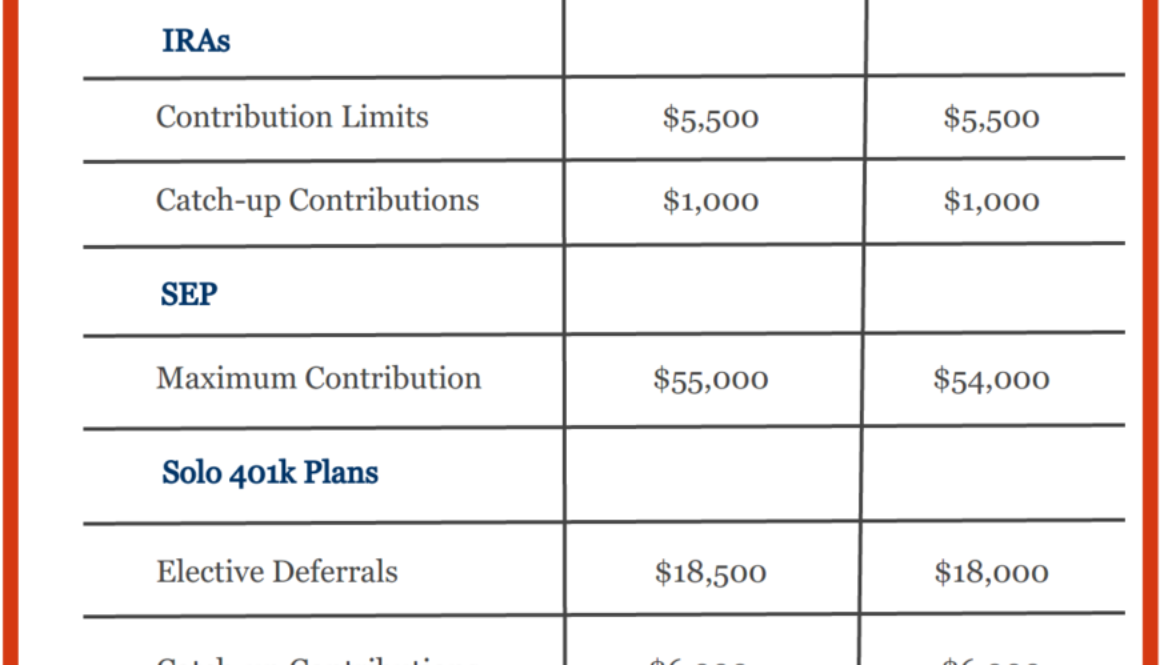

Solo 401k Rules Solo 401 k Small Business, The roth solo 401 (k) contribution limit for 2025 is $23,000 for employee contributions. (those limits will jump to $23,000/$30,500 for 2025.) as an employer, he can also make additional contributions up to 20% of adjusted net earnings.

How much can i contribute to my solo 401 (k) in 2025 and 2023?

The Maximum 401(k) Contribution Limit For 2025, This limit is per participant. For 2025, the max is $69,000 and $76,500 if you are 50 years old or older.

TotalSolo401kContributionLimitsfor2023and2025 My Solo 401k, (those limits will jump to $23,000/$30,500 for 2025.) as an employer, he can also make additional contributions up to 20% of adjusted net earnings. Workers age 50 or older can kick in additional amounts.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, For 2025, the max is $69,000 and $76,500 if you are 50 years old or older. What are the new solo 401k contribution limits for 2025?

For 2025, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you're 50 or older.

Solo 401k Contribution Limits for 2025 and 2025, If you're age 50 or. For 2023, that limit is $66,000.

Solo 401k Employee Contribution Limits 2025. In essence, you're deferring part of your salary by putting it in a 401k. One of the biggest advantages of a solo 401 (k) is that it has the highest contribution.

401k 2025 Contribution Limit Chart, In essence, you're deferring part of your salary by putting it in a 401k. For more detailed information, read on.